Whether you are a newbie or a seasoned trader, there are several factors that you need to consider before starting a crypto market-making strategy. You need to consider factors like market volatility, market liquidity, and your ability to handle risk. These factors are important because they affect your strategy’s success. However, if you hire a reputable crypto market-making company, you can rest assured that you are not taking on unrealistic expectations. Moreover, a reputable company will ensure that your orders are filled properly and that your spreads are tight.

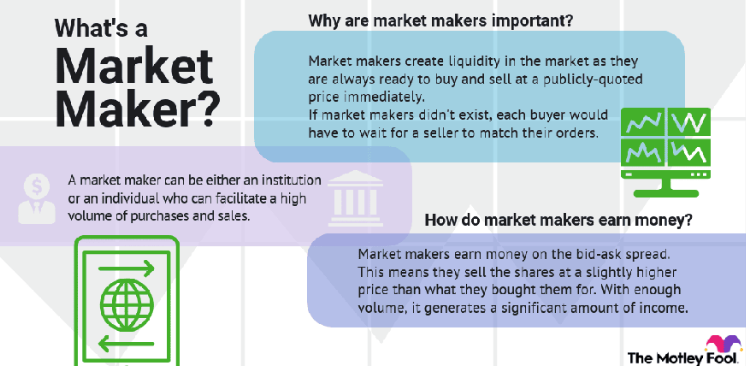

Generally, market-making involves trading in a way that avoids building up large net positions. Instead, you create a broader market for traders to trade assets. This is accomplished by purchasing assets from holders and holding them to increase the price of the asset. Generally, the market maker sets the price for the asset to reflect the supply and demand. This can be done for a variety of different tokens.

In the past, market-making strategies were limited to large financial institutions. However, the crypto industry has become mainstream and more individuals are interested in using these strategies. Consequently, there is an increased need for reliable crypto market-making services. To ensure that your exchange is successful globally, it is important to hire a reputable crypto market-making company.

Market making is a great way to increase the volume of trading in the crypto market. It also helps to increase liquidity. Liquidity is a crucial part of the crypto trading industry because it allows the entry of new traders. A market maker also helps increase the order book depth, which is a great way to build trust and confidence in the market. Having a healthy order book is a key priority for a volatile financial market.

The order book depth of a market maker is important because it allows both buyers and sellers to execute orders at any time. A market maker is a high-volume trader who makes money off of the difference between the bid-ask spread. These traders can buy and sell at low costs and higher prices. Market making also helps to provide liquidity to the market by buying and selling assets at the market’s price. Market makers use a wide range of strategies to ensure that they can successfully carry out their trades. Depending on the crypto market you want to trade in, you will need to find a market-making bot that can meet your needs.

The best crypto market-making services provide strategies that are designed to improve the liquidity depth in the order book. These strategies are also designed to attract more investors. For instance, Kairon Labs, one of the best crypto market-making companies in the world, offers customized solutions and strategies that help boost organic volumes and decrease bid-ask spreads. In addition, Kairon Labs also offers bi-weekly reports, updates, and conference calls.