Between fiscal year 2018 and 2019, personal loans have become one of the most popular modes of unsecured financing in India. Such growth in demand is largely attributed to a shifting spending pattern, the availability of such credits from different financial institutions, and the integration of various methods including online and in-app application systems to streamline the application procedure.

Most financial institutions have also embraced the changing technology and developed dedicated platforms like instant loan apps, allowing borrowers to obtain credit instantaneously without any hassles.

Individuals can apply for easy loans without pledging collateral through the following steps –

Step 1 – Select a preferred financial institution.

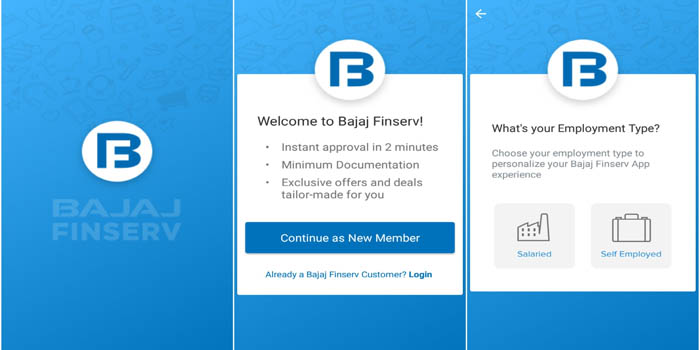

Step 2 – Download the corresponding app developed by the chosen NBFC from the Google Play store/iOS store.

Step 3 – Fill out the application form by providing your mobile number and email ID. An OTP will be sent to this phone number, using which individuals can easily log in.

Step 4 – One will also have to provide their PAN Card number along with their permanent address. Scanned copies of resident proof might be needed for further verification purposes.

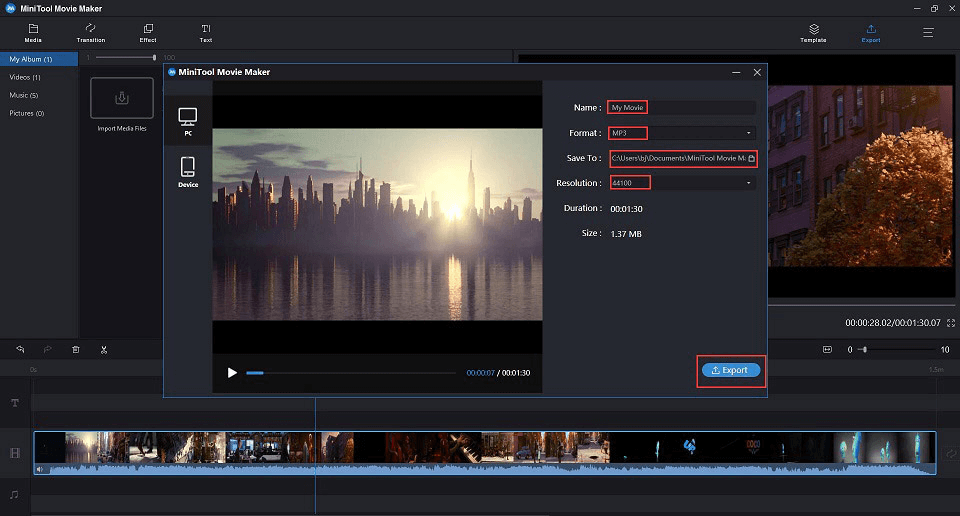

Step 5 – The quick loan app will ask for the sum of funds an applicant wishes to avail.

Step 6 – The loan application verification process usually starts instantly and takes only a few minutes to complete. After successful authentication, the loan disbursal process is initiated. The total amount is usually disbursed within 2 to 3 working days.

Major financial institutions such as Bajaj Finserv provide such instant loans on their dedicated Bajaj Finserv App – Experia. Apart from acting as a loan app fulfilling immediate credit requirements of individuals, these mobile applications provide several other benefits, such as –

- Ease of loan account management

Such an app provides easy access to all the necessary details regarding one’s loan account, including complete information about EMI payments as well as due dates, number of EMIs left, etc. It helps borrowers keep track of their finances.

- Account history

Information regarding all forms of credit availed by an individual (from a particular financial institution) can be accessed from that organization’s official app. Statements of the same can be downloaded as and when required by borrowers.

- 24×7 customer support

Online customer helpline desks of major financial institutions can be accessed at any time. Individuals can either call or message to convey their grievances. Actions to resolve the same can be processed immediately.

Another major benefit of using a dedicated mobile application is the added features and benefits offered to the customers. For example, existing customers can avail of benefits like faster approval and minimum documentation while applying for credit.

Major non-banking financial corporations, including lenders like Bajaj Finserv, provide pre-approved offers on various forms of advances. The information regarding such facilities can be accessed through the instant loan app.

Such offers are available on different lending options, including secured advances like home loans as well as unsecured credits like business loans and personal loans. You can take a look at your pre-approved offer by providing your name and phone number.

These high-value loans can be availed instantaneously without pledging any collateral, provided an applicant meets the minimum eligibility criteria. A borrower has to satisfy the following conditions to avail such credit at a competitive interest rate –

- Age- A potential borrower should be between 23 and 55 years while applying for such loans.

- Salary- Salaried applicants have to submit their salary slips for the past three months to apply for such a credit. These documents verify the repayment capacity of a potential borrower. Sound repayment capability reflects the credibility of individuals, thereby increasing the chances of getting high-value loans sanctioned in their name.

- CIBIL score- An applicant should have a CIBIL score of 750 and higher to avail of a personal loan from any financial institution successfully.

While obtaining a personal loan through the instant loan app, all debt-to-income ratios of an individual should be kept in mind, as that directly affects his/her ability to meet EMI payments on time. Loan tenors can be chosen accordingly, ensuring no excessive burden is levied on individuals to meet all repayment deadlines.

Availing a personal loan through such a personal loan app is an easy way of fulfilling financial requirements. Such loans are sanctioned instantaneously and have no associated end-use restrictions, allowing borrowers to use the procured funds to meet any monetary deficiency.